Client education has never been so important

As an industry, we have faced unprecedented change and challenge.

Together, we have an opportunity to help reshape and rebuild.

From our extensive, behavioural science-led customer and adviser research, we’ve learned how life insurance customers feel about the industry, including:

- Trust is critical, and isn't currently at the levels it needs to be

- Customers want to know that their interests come before shareholder value

- The complexity of life insurance is intimidating. Customers need our help to bridge the knowledge gaps they have

- We need to eliminate uncertainty and deliver value, by demonstrating that claims will, and do, get paid.

If we don't take steps to engage and educate customers about their cover, we risk eroding the value of insurance. We risk making it harder for you to attract and retain your clients.

So, we've built the tools to help.

This is the start of our journey together towards a better experience for your clients.

The solution is Clarity

We’re giving you the tools you need to engage and educate your clients – instilling in them a new level of certainty and understanding when it comes to their life insurance.

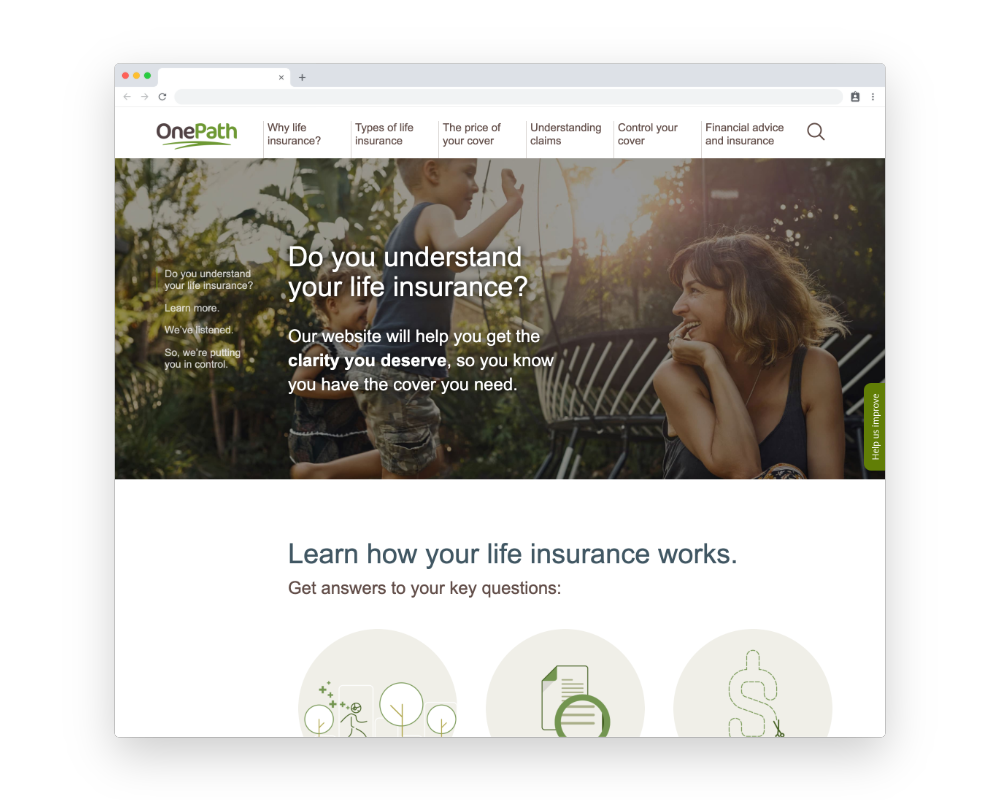

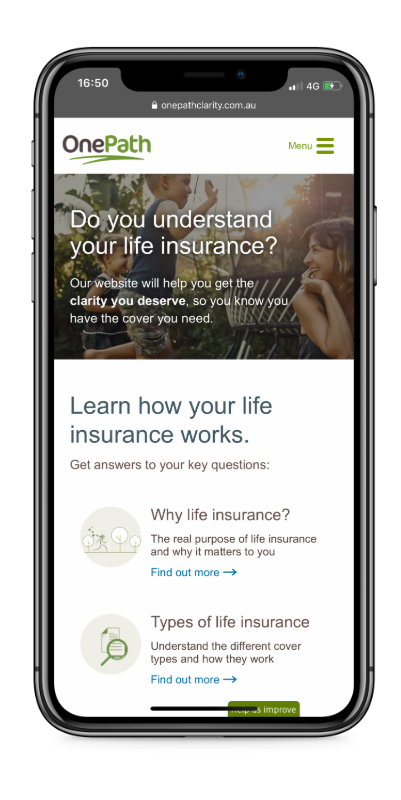

1. OnePath Clarity customer website

The OnePath Clarity customer website features a comprehensive digital library of videos, animations, infographics, articles and compelling stories addressing the six key areas of concern to life insurance customers. All content has been created using behavioural science to simplify life insurance fundamentals.

Visit onepathclarity.com.au for more.

2. White-labelled content

Using content from OnePath Clarity, we’ve built a library of white-labelled, fully customisable content designed to help you demonstrate your insurance expertise.

Each document below contains our content in both article and social media formats, giving you flexibility on how you want to use it.*

Educate clients on what to expect from financial advice and the importance of several parts of the life insurance journey.

Science behind why we need life insurance

Article and Social Post content

How to prepare for the appointment

Article and Social Post content

Power of Disclosure

Article and Social Post content

The insider’s advantage

Article and Social Post content

6 questions to ask a financial planner

Article and Social Post content

Myths about insurance you need to know

Article and Social Post content

Everything your clients need to know about how their premiums are calculated, and why they sometimes change.

Affordability options

Article and Social Post content

Why premiums go up

Article and Social Post content

How premiums are calculated

Article and Social Post content

Difference between stepped and level premiums

Article and Social Post content

Ways to buy and own insurance

Article and Social Post content

What is indexation and how it works

Article and Social Post content

Articles that build certainty by explaining the claims process, including how we make claims decisions.

Do life insurers really pay claims?

Article and Social Post content

Why there's more to life insurance than money

Article and Social Post content

Educate clients on the importance of reviewing their cover, and what they should consider to get more control.

Upcoming renewal reminder review

Article and Social Post content

The easy way to top up your life insurance

Article and Social Post content

Why it pays to review to your cover

Article and Social Post content

Educate clients on the importance of reviewing their cover, and what they should consider to get more control.

There are 4 main types of life insurance

Article and Social Post content

TPD cover - 3 things your client needs to know

Article and Social Post content

Trauma cover - 3 things your client needs to know

Article and Social Post content

Life insurance - 3 things your client needs to know

Article and Social Post content

Income protection - 3 things your client needs to know

Article and Social Post content

3. Your step-by-step guide to delivering Clarity

Marketing with Clarity is a practical guide that walks you through how to deliver white-labelled Clarity content to your clients in the most effective way – helping you deepen your client relationships and deliver value. The step-by-step guide includes:

- Setting up the basics to help you understand the various communication channels available and the best way to use them – setting you up for successful client engagement.

- Recommended Content Programs, to allow advisers to plan their Clarity content marketing activity, personalise their communications, and ensure they are sending their clients the right messages at the right times.

- Enhanced marketing masterclasses and tips through _ZONE, our adviser education platform.

- Get a head start on your planning with a 12 month pre-filled communications calendar.

- Ready-made newsletter and flyer templates below, allow you to insert your logo and any white-label content for a speedy but considered communication.

Ready-made templates and images

To make it even easier for you to share OnePath Clarity content in your own brand, we’ve created a collection of white-labelled templates – including easy-to-format flyers and newsletters.*

Flyer - Basic

Flyer - Standard

Flyer - Professional

Newsletter - Basic

Newsletter - Standard

Newsletter - Professional

Images

To make the most of this content, speak to your BDM to find out more.

* OnePath Life allows financial advisers who have been given access to the white-labelled articles to customise its content and logo including any relevant disclaimers and send to clients via email or social media without having to seek the prior written consent of OnePath Life.

Important information

This information and white-labelled articles (“information”) are prepared by OnePath Life Limited (ABN 33 009 657 176, AFSL 238341). It is current as at September 2019 but may be subject to change. It is for the use of advisers only and may not be reproduced without the prior written consent of OnePath Life unless it is indicated otherwise.

While OnePath Life has taken care to ensure that this information is from reliable sources, it cannot warrant its accuracy, completeness or suitability for your intended use. To the extent permitted by law, OnePath Life does not accept any responsibility or liability arising from your use of this information.

This information and white-labelled articles (“information”) provided are of a general nature and have been prepared without taking account of your client’s objectives, financial situation or needs. Before acting on the information, your client should consider whether the information is appropriate, having regard to their objectives, financial situation and needs.

Full product information including fees, charges, terms and conditions is available in the relevant Product Disclosure Statement available at www.onepath.com.au or by contacting your Business Development Manager.